Online casinos are popular all over the world, and Slovak players are not an exception. Security at an online casino becomes relevant for Slovak players in terms of protecting their personal and financial information. For example, Zodiac casino, players consider as a place where one can have fun yet feel secure. In this article, we will explore how Slovak players can secure themselves and their data while they enjoy online casinos, go through practical advice on choosing safe platforms, using secure payment methods, and avoiding common risks.

Understanding the Importance of Online Gambling Security

In online gaming, security is the number one priority. Without security, players would make themselves vulnerable to leakage of personal information, financial transactions, and even the integrity of their gaming experience. Fortunately, online casinos have adapted different technologies and practices that assure a secure and fair environment. In this section, we are going to break down the primary security elements every Slovak gambler should consider.

1. Licensing and Regulation

Some of the first things any player checks before entering an online casino include its licensure. A legitimate online casino is usually licensed by a reputable regulatory authority, such as the UK Gambling Commission or Malta Gaming Authority. These licenses ensure the casino operates by rigid rules concerning data protection, fairness, and responsible gambling.

2. Secure Connection and Encryption

Online casinos use high-tech and advanced encryption technologies, such as SSL, in order to guard against the leakage of their players’ personal and financial information. Encryption via SSL ensures that sensitive information, like bank details or identification documents, remains secure while being transmitted over the internet. Always make sure that there is a padlock symbol within the address bar of your browser; this means that a website is safe.

3. Payment Security

Slovak players should also be circumspect with the question of deposit and withdrawal options. To avoid such problems, prefer payment systems that provide better security: e-wallets such as PayPal or Skrill, credit cards, and well-known cryptocurrencies, like Bitcoin. Such payment systems often have additional security mechanisms, such as two-step authentication, to support financial transactions.

4. Politics of Privacy

Read through the casino’s privacy policy before signing up; this gives an indication of how the handling of player data is being done, what information can be collected, and how it will be used. Also, try to see casinos whose assurance is that they do not share personal information with third-party organizations without your consent.

5. Responsible Gambling Measures

Another critical part of online casino security in regard to responsible gaming is that a secure platform should include features such as self-exclusion, limits on deposits and losses, and access to support services for players experiencing gambling addiction. Slovak players should make sure to choose those platforms where responsible gaming is part of their policy so they can enjoy safe and controlled fun.

Best Practices for Online Casino Players

While online casinos do everything in their power to make an environment as secure as it can get, players have to take some steps, too. Here are some best practices for Slovak players to observe:

Strong Passwords: One should always use complex, unique passwords for each online account. Never use common passwords and easily guessed ones. Consider using password managers that can securely store all of your passwords.

Activate Two-factor authentication: Enable two-factor authentication, if provided, for additional protection on your casino account. Besides password protection, 2FA offers an additional layer of protection.

Shun Public Wi-Fi: Refrain from accessing online casinos or making financial transactions over any public Wi-Fi network. Public Wi-Fi access is not as secure, and it might expose personal data to cyber thieves.

Keep Software Up to Date: Your operating system, browser, and antivirus software should be updated regularly. Updates fix the latest security threats in order for one to be better protected from those threats.

Prioritize Security for Safe and Enjoyable Gaming

Online casinos offer exciting entertainment, but security is always the first and most important priority. Slovak players should select licensed regulated platforms with robust encryption and privacy protections. In this way, by following best practices and using reliable payment methods, players can also enjoy online gaming without compromising their safety. Responsible gambling, after all, is the way to make sure the fun is safe. Whether any even reputable gaming venue, never compromise on your data security to keep both yourself and your winnings safe.

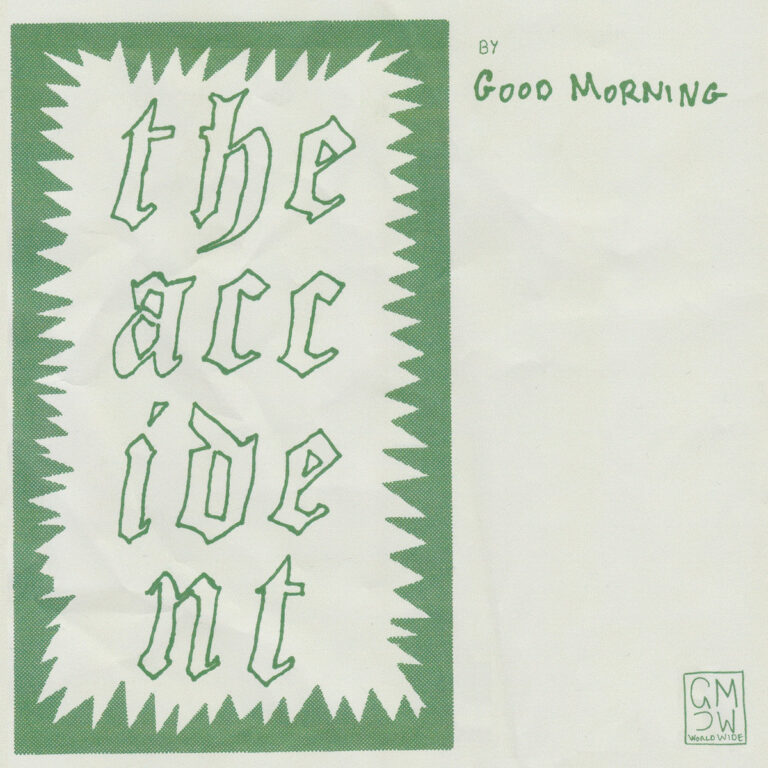

Australian duo Good Morning have released their eighth album,

Australian duo Good Morning have released their eighth album,

British producer Mark Barrott has released a new album,

British producer Mark Barrott has released a new album,  Juanita Stein has unveiled her fourth solo LP,

Juanita Stein has unveiled her fourth solo LP,  The Innocence Mission – the husband-and-wife folk duo of Karen and Don Per – are back with a new LP,

The Innocence Mission – the husband-and-wife folk duo of Karen and Don Per – are back with a new LP,  total tommy – the moniker of Sydney-based artist Jess Holt – has dropped her debut album,

total tommy – the moniker of Sydney-based artist Jess Holt – has dropped her debut album,